Digital Currency Primer

(not even close to being up to date)

contact me with questions and thoughts

310 878-2260

50 minute webinar repeat

BlockChain: Instead of Why, Ask Why Not?

The distributed ledger technology underlying cryptocurrency is advancing quickly, requiring banks to take the initiative or risk falling behind in the next generation of digital commerce.

Original Article

Ask a group of bank technology executives what they might have done differently in the past three to five years, and the responses come easily: We could have wrestled with the data monster differently, laid out a foundational architecture sooner, dived deeper into analytics and customer insights, and had a more cohesive business strategy advanced by digital rather than a tactical mobile strategy.

All legitimate, honest regrets. But unless they act soon, some banking leaders could soon be adding one more item to that list — waiting too long on blockchain. The hesitancy is understandable. The rollout of blockchain-based digital currencies during the past few years has produced its share of ripped-from-the-headlines stories reporting on wild price fluctuations and exchange collapses.

The technology underlying cryptocurrency is building undeniable momentum, with the potential for momentous impact on financial services, the world of commerce and society at large. Quickly gaining a reputation, if not full legitimacy, as the “Internet of finance,” blockchain provides the digital ledger that enables Bitcoin, BitShares, Ethereum, OneCoin™, Ripple and hundreds of their crypto kin to transfer assets more quickly, reliably and securely.

Blockchain is still new, though. And from conversations we’re having with our clients, it’s apparent that leaders of the cautious-by-nature financial services industry are both excited and apprehensive. Should we make the leap to gain first-mover advantage? Should we give it a couple more years to mature? Wait for the various blockchain consortia and open source communities to sort it out and bet on the winner? Just keep collecting the float from traditional transactions while it lasts?

We predict banks will generate value from their initial investments in blockchain without necessarily facing the predictable snafus and hiccups on the front lines that typically accompany major technology and process shifts. Through some highly targeted approaches, many of which we are piloting today, banks can learn about and experiment with blockchain (see sidebar for a gallery of blockchain pilots). In this way, banks can better understand its potential and perhaps grab some quick wins in the realms of document exchange, record-keeping, multi-signature and digital asset transfer using smart contracts.

Quick Take

A question we’ve heard bankers ask earnestly and repeatedly is what problem does blockchain solve? Is this a solution in search of a problem? Well, the answer is that while blockchain can be focused on solving existing efficiency problems, it could also be targeted at creating new opportunities and business models.

Blockchain: Disrupting the Financial Services Industry

Blockchain’s Key Benefits

Blockchain offers financial institutions several important benefits, including:

- Enhanced security.Banks work heroically to protect customer and enterprise data, but breaches are inevitable. Blockchain elevates security through cryptography and a tamper-resistant design, while eliminating the risk of a single point of failure. If a breach does occur, its location can be determined and isolated, precisely and quickly.

- Simplification and cost reduction. Blockchain can simplify processes in a friction-filled market by removing the need for intermediaries and manual processes. The shared infrastructure can help reduce costs within the bank and at an industry level. Santander InnoVentures estimates that banks can save $20 billion a year by implementing blockchain technology.

- Regulators are likely licking their chops at blockchain’s potential. With access to blockchains, authorities can see the specifics of transactions for themselves instead of relying on the veracity of banks’ reporting. The question is how ready banks will be when regulators demand blockchain transparency.

Recognizing these benefits, some financial institutions are already in the game. Japan’s Mizuho Bank conducted a three-month trial, completed in March, that used blockchain to speed cross-border instrument transfer. Bank of America has filed 15 blockchain-related patents and has 20 more in the works. The Bank of Ireland recently completed a blockchain trial centered on trade reporting. R3 just announced the development of a Corda distributed ledger fit for purpose for financial services. R3 is also working on at least eight different proofs-of-concept (PoC) to show how distributed ledgers can be used to streamline a wide range of transactions on Wall Street and make them easier to regulate.

Starting Points for Blockchain

The following suggestions can help banks develop a path for moving forward with blockchain:

- Keep an open mind. Sharing blockchain’s potential within your enterprise can uncover new approaches and use cases. Identify and involve a core set of evangelists and seed them within your business and technology teams to drive true innovation.

- Become better educated.In building awareness of blockchain within your organization, first become knowledgeable about its opportunities, risks and limitations. For example, learn about how smart contracts can open the door to digital asset transfer, as well as a host of other applications. Could they fundamentally improve your current business processes? Further, as you make investments in IT, consider one option in the list of possible future states that might include blockchain and evaluate decision-making in the context of such a possibility. Does this require your organization to make different decisions, or at the very least keep team members open to such a possibility?

- Explore blockchain’s potential. Search for ways that blockchain might fit into your current enterprise landscape, as well as the business and technology process changes needed to realize value from each use of blockchain. Your organization doesn’t need to wait for interoperability with the outside world to reap blockchain rewards (i.e., streamlining costly internal processes).

- Find a pain point and work it. A good way to build your organization’s awareness and interest around blockchain is to identify a problem that provides hands-on experience with the technology. This “hedge” investment can be a lever for spreading the word about blockchain to a broader audience within your bank, without spending millions of dollars. Perform a small PoC using available solution accelerators and establish a point of view on particular business process areas for which blockchain can provide benefits. Pilots provide necessary hands-on experience to your teams and allow new thinking on how business processes can be significantly improved by harnessing the power of blockchain. Iteratively work on enhancing the pilot.

For example, one of our clients began its journey by building a PoC, using our accelerators, to enable document-sharing between bank subsidiaries that leverage smart contracts. The first iteration focused on proving the capability; the second iteration is about scaling the solution and understanding how business processes need to be aligned to best leverage its potential benefits.

For another client, we are performing technology proofs to enable multi-signer asset transfer capabilities that leverage smart contracts. Discussions are in process about how that capability might be scaled.

Another option to consider is a private internal blockchain to improve record-keeping for audits, create shared databases between subsidiaries and streamline back-office operations. The possibilities are diverse.

- Consider your consortium and partners. If your organization is already part of a consortium, or is considering one, expectations should be defined very carefully. Is it enough to put your organization’s name on the consortium, or can the relationship provide added value through more active participation? Your team will still need help integrating blockchain into your bank’s back office. This typically requires broader partner discussions to prepare for the future.

Taking the Initiative

We strongly believe that by getting out front on blockchain, a few early adopters will reap major returns on their blockchain investments. Meanwhile, others will wait and see, hoping for greater clarity and, perhaps, consortium consensus. It doesn’t have to be an either/or situation, though. Learn more about what’s at stake. Build interest. And pick some paths to experiment with and embrace the technology. Blockchain’s coming. Probably sooner than we think.

This article was written by Prasad Chintamaneni, President, Global Industries and Consulting at Cognizant, and Lata Varghese, who leads the blockchain consulting practice for Cognizant and is actively helping clients understand distributed ledger technology and evaluate technology providers emerging in the stack. They can be reached at [email protected] and [email protected], respectively.

To learn more about block chain, please read the full whitepaper, “Blockchain: Instead of Why, Ask Why Not?” and visit the Banking and Financial Services section of our website.

A new Congressional resolution HR 835

– Support and teach Digital Currency

With a new bipartisan bill HR 835 by the House of Representatives, a call has been issued to the US Government to adopt a national policy to promote citizens’ access to new financial innovation including blockchain and digital currencies.

A new Congressional resolution is calling on the United States government to support the development and ease of access to financial tools including blockchain, digital currencies and FinTech. The resolution seeks a national policy for technology in order to achieve those goals.

The bipartisan bill resolution sees its title as “Expressing the sense of the House of Representatives that the United States should adopt a national policy for technology to promote consumers’ access to financial tools and online commerce to promote economic growth and consumer empowerment.”

The resolution implies that citizens’ access to digital currencies like bitcoin should be supported, referring to cryptocurrencies as “alternative non-fiat currencies” which the resolution sees as “emerging payment options”.

To this end, In no uncertain terms, the House of Representatives’ bill states that:

The United States should prioritize accelerating the development of alternative technologies that support transparency, security, and authentication in a way that recognizes their benefits, allows for future innovation, and responsibly protects consumers’ personal information.

Citing “increased transparency” as facets of digital currencies, the resolution notes that its inherent trust properties can “supplant decades-old payment technology deployed by traditional financial institutions.”

The resolution specifically underlines blockchain technology, which with “appropriate protections” it states can “fundamentally change” the current method in which trust and security are established and verified in online transactions. The resolution also points to specific sectors where blockchain can shine in its potential, namely: financial services, the payments industry, healthcare, energy, property management and intellectual property management.

The resolution sees co-sponsors in Rep Adam Kinzinger, a Republican from Indiana and Rep Tony Cardenas, a Democrat from California.

Introduced into the House on July 14, the resolution is now referred to the House Committee on Energy and Commerce. The status of the bill and subsequent updates can be found here.

10 Warning Signs That Digital Currency is Replacing Money

01 Jul, 2014 by Susanne Posel Print this article Font size –16+

Susanne Posel ,Chief Editor Occupy Corporatism | The US Independent

found at: https://www.occupycorporatism.com/10-warning-signs-that-digital-currency-is-replacing-money

Roger Dickenson, assemblyman in California and author of Section 107 which allows for corporations or individuals to issue tradable legal tender other than US dollars, said : “In an era of evolving payment methods, from Amazon Coins to Starbucks Stars, it is impractical to ignore the growing use of cash alternatives. This bill is intended to fine-tune current law to address Californians’ payment habits in the mobile and digital fields.”

California bill AB 129 “repeals an outdated restriction on the use of ‘anything but the lawful money of the United States’.”

This bill acknowledges popular digital currencies as legitimate, including:

• Bitcoin

• Ripple

• Litecoin

• Peercoin

• Namecoin

• Dogecoin

• Primecoin

Dickenson explained: “The literal meaning of the restriction indicates that anyone using alternative currency is in violation of the law. However, people commonly use digital currency, community currency, and reward points without penalty.”

Economist Daniel Altman explains that Bitcoin only has value “because people want to use it.”

Bitcoin has been given that status of a “payment service provider” (PSP) by French financial institutions Aqoba and Crédit Mutuel. Officially, they are not a PSP because of the banks they are aligned with who are. This means Bitcoin is able to take advantage of their PSP status without having to be one themself.

Crédit Mutuel is the “main component of the Crédit Mutuel-CIC Group” which includes a federation of French financial institutions that have assets totaling over $581 billion. The federation’s holding corporation, the Banque Federative du Crédit Mutuel (BFCM) control French and foreign operational subsidiaries in Germany, Belgium, Spain and Portugal.

Bitcoin now has an International Bank ID number (IBAN) which allows transactions through PayPal and WorldPay and other digital payment networks; as well as issue debit cards, enabled to process monetary transfers to other banks and accept transfer of digital currency to their own “location”.

A Bitcoin account will be as viable as any other bank account with other established banks worldwide.

Deposits will be subject to compensatory laws that are applicable when dealing with printed fiat in traditional accounts and balances in Bitcoin accounts can be exchanged for the fiat in that country (i.e. euros, US dollars, Yaun, etc. . . ).

Last March, the Internal Revenue Service (IRS) said in a statement that bitcoins and other crypto-currencies are to be taxed as property – not as currency.

The IRS said: “General tax principles that apply to property transactions apply to transactions using virtual currency.”

This means that bitcoins will be taxed as “ordinary income or as assets subject to capital gains taxes” under the correct circumstances.

According to the IRS crypto-currencies will not be “treated as legal-tender currency” and the US dollar value of virtual currencies will be subject to taxation on gains and losses just as property transactions are calculated.

The IRS statement reads: “The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. If a taxpayer holds virtual currency as capital – like stocks or bonds or other investment property – gains or losses are realized as capital gains or losses. However, when virtual currency is held as inventory or other property mainly for sale to customers in a trade or business, ordinary gains or losses are generally incurred.”

Bitcoins that are “held by investors” will be treated as though it were “stock or other tangible property. If the virtual currency is held for investment, any gains would be treated as capital gains, meaning they could be subject to lower tax rates.”

According to Publication 525, Taxable and Nontaxable Income, “a taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in U.S. dollars, as of the date that the virtual currency was received.”

This publication also states that a taxpayer who “mines” virtual currency is then subject to the fair market value of the US dollar at the time of mining which would translate to the date of receipt. This is considered gross income.

As outlined in Publication 551, the Basis of Assets, that virtual currency is subject to “fair market value of the virtual currency in US dollars as of the date of receipt.”

Fair market value of virtual currency is required to be determined in US dollars. Additionally, virtual currency that is listed on the stock exchange must be valued by its ability to be converted to US dollars.

Read the rest of the article at link above

The NEW Money: Cash Traditional Credit Cards Are Done

For

Here’s what will replace them… and how we can profit

found at: http://secure.stansberryresearch.com/the-new-money-cash-and-traditional-credit-cards-are-done-for-2/

In less than five years, money as you know it will have completely changed…

In less than five years, your kids won’t carry wallets. They won’t carry cash. They won’t carry credit cards.

In place of all of this, they will carry just one thing: their mobile phones.

It won’t just be your kids, by the way…

In less than five years, you will use your BlockChain encrypted phone to pay for almost everything.

This sounds preposterous, I realize… It’s crazy to even consider when NOBODY here does this – yet.

But it’s coming. Without a doubt.

Surprisingly, nobody’s talking about it.

This is exactly what I want to see as an investor… It’s an unstoppable trend… that nobody is talking about.

Who will be the winners and losers in this trend? We can’t know for sure, as it will be a dramatic change. But I have been studying this, and today I will share with you the best way for us to safely capitalize on this trend.

Again, this is an unstoppable trend… that nobody is talking about.

It will be the greatest transformation of how people pay for stuff since, well, since people started paying for stuff. We have to get out ahead of it…

Let’s get started…

‘I’m Not on Board With You, Steve’

“Why even bother paying with your phone?” you might ask. “What’s wrong with cash and credit cards? We’ve used them forever.”

I hear you. You’re not on board, yet. Most people aren’t. I get it.

“Steve, paying on your mobile phone sounds ridiculous,” you might think… “It couldn’t possibly be safe or secure.”

I hear you, again. But you are wrong on this one… Paying with your phone is safer because you avoid the current problem of revealing your name or credit-card number to whomever you are paying.

(The secret is called “tokenization.” When you pay with your phone, a one-time-use number – a “token” – is all that’s created. Your name and credit card number are never seen, and therefore, they can’t be stolen. Similar to BlockChain digital currency)

Paying with your phone is more convenient, too… It’s faster than fumbling for cash or waiting on that stupid credit-card chip approval.

“Well I’m not switching – no matter what… Don’t even try to get me to give up my old ways.”

Once again, I hear you. But mark my words… YOU WILL DO THIS. And you will do it much sooner than you think.

What? You still want to resist me on this?

Every time you swipe your credit card, or type it in online, you risk getting hacked… You give up your name and your credit-card number.

You’re telling me that you prefer having a much higher chance of getting your credit card hacked? And that you prefer the inconvenience of fumbling around in your pockets and your wallet with cash and change at the counter when you don’t have to?

There’s a more convenient, more secure, and safer way to use money. It’s your mobile phone.

“I don’t trust this Steve. It sounds complicated, and I don’t like making changes.” Excuses, excuses…

You’re not alone, though. A recent survey found that most Americans agree. They’re afraid of mobile payments for no good reason. Take a look…

Think of this in reverse…

What if the old way we paid each other was by mobile phone? What if you were already used to paying by simply holding your phone out for a second or two?

Then someone came up with the invention of a credit card… Would you switch to a credit card? Of course not. Think of what you’d say…

- You mean I have to carry this piece of plastic around with me in addition to my phone? Why?

- Then I have to stick it in the chip reader and waste 10 SECONDS of my life waiting? Are you kidding?

- What? That’s not all? Then I have to sign a little screen, too? Really?

- And I have to give away my name and credit-card number to anyone I want to pay?

- And then that information could be hacked?

That sounds like a terrible deal.

If we were already paying with our phones and someone invented the credit card, it would be dead on arrival. Nobody would use it. It wouldn’t make any sense.

When you realize this, you realize that the traditional credit card – the piece of plastic in your wallet – is done for. I don’t mean it will be gone completely. Here’s what I mean:

In about five years, I believe, nearly everyone will prefer paying with their phone. I realize that’s hard to believe, when basically nobody in America is doing this now. But they will.

You might wonder what gives me such strong conviction that basically all of us will adopt this – and we will do it quickly. The answer is simple: My first trip to China over the summer proved it to me 100%.

It sounds crazy to say that I saw the future in China. But I did. The Chinese people are about three years ahead of us in adopting this technology. In China’s big cities, I saw two things:

- Everyone prefers paying with their phone. They HATE using cash, and traditional credit cards are basically irrelevant.

- For convenience, most people prefer staying within one “app,” or one “ecosystem.” (I will explain more about this idea in a minute.)

These are the two big ideas. This is what I expect will be true in America as well.

While we can’t know exactly how it will play out here in the U.S., we do have the luxury of a pretty good blueprint… It’s what’s happened in China over the past three years. The basics of what we’ll see are:

- A quick transition to mobile payments, and

- People staying with what’s “convenient” on their phone – that is, staying within one “ecosystem.”

Before I get too deep into that, let’s back up… What’s it like to pay with your phone instead of cash or a credit card?

Exactly What It’s Like to Pay With Your Phone

I paid for lunch at Panera Bread today… with my phone…

Instead of pulling out a credit card or cash after I ordered, I simply swiped my phone over the credit-card reader. Boom. Done. That’s it.

It’s a bit anticlimactic, really…

There’s no “thrill” to it… You’re already holding your phone out… And then your phone says you paid, and the receipt appears on your screen. That’s it.

It’s quite unexciting. There’s no digging in your purse, no fumbling for cash and credit cards, no card swiping, no signing, and no fumbling to put everything away.

Instead… nothing happens. You hold your phone… and then… you’re done.

But what’s going on behind the scenes? This is where it gets good…

You see, the magnetic strip on your credit card carries your name, account number, and expiration date. When you swipe it at a store or restaurant, you relinquish that information over to the merchant. And that’s the problem… Now your data is out there, and hackers can get to it.

However, when you pay with your phone, nobody can see your name or your credit-card number… because they weren’t ever shown. That’s what makes this safer than pulling out your credit card… With “tokenization,” your name and your credit-card number never appear – therefore, this way they can’t be stolen.

Are Traditional Credit-Card Companies Done For?

So… If everyone is going to switch to mobile payments and move away from cash and traditional credit cards, are the credit-card companies done for?

The reality is the opposite… The major credit-card companies are the only guaranteed winners in mobile payments…

You see, regardless of whether you’re using an Apple iPhone or an Android phone… regardless of which bank you use… Nearly all mobile payments are ultimately processed by the major credit-card company networks – particularly Visa and MasterCard.

Instead of losing “market share” as people move away from cash and traditional credit cards, the major credit-card companies will do the opposite… They will gain market share, as more payments will pass through their networks.

Case Study: Starbucks…

|

PayPal Is the Incumbent… But It Might Not Be the Winner

I don’t know about you, but I use PayPal all the time…

PayPal is just so much more convenient than paying with a credit card in many cases. You can often buy instantly (like on eBay) or with just a click or two. Meanwhile, buying concert tickets with a credit card often takes five minutes, and you have to type all your personal information into yet another website. I would prefer not to do that.

PayPal is the leader in mobile payments in the U.S., by far. However, PayPal’s big risk is that it’s not part of an already existing “ecosystem.”

This “ecosystem” concept is incredibly powerful.

WeChat is the dominant “ecosystem” in China. People do EVERYTHING within WeChat. WeChat’s payment system didn’t really get going until 2013. And now it’s massive. It’s second to Alipay, but with more than 700 million loyal WeChat users, it’s gaining market share daily.

I expect WeChat’s parent company, Tencent, will become the world’s largest company within five years – all because of the “ecosystem” that it has built.

Here in the States, we don’t have a big winner like WeChat, yet… But the dominant players are obvious…

My kids practically live on Snapchat on their phones… It is their hub of communication. Likewise, Facebook is sort of the grown-ups’ version of Snapchat.

Apple has an incredibly powerful ecosystem, as well. My son switched to an Apple iPhone because all his buddies were using iMessage, and without an iPhone he couldn’t be a part of it.

For you and me, Apple and Android have ecosystems in place. And they are both so darn good at keeping you in their ecosystems. We pretty much have to pick teams – Apple or Android?

And as I learned in China, you can’t underestimate the power of creating these ecosystems that people don’t want to leave. We are already in them. We don’t want to start with something new. Therefore:

I expect that Apple Pay and Android Pay will become the dominant “mobile wallets” here in the U.S. – simply because our desire to keep everything simple trumps everything else.

I could be wrong of course… They’re not the only competitors.

Take Samsung Pay, for example…

Android Pay and Apple Pay only work on newer credit-card readers.

But Samsung Pay is different… It can be used on virtually all existing credit-card processors. In theory, you can even use it at the old gas station or corner store that hasn’t updated its card reader in decades.

How? Samsung Pay uses a technology that fakes like your phone has a magnetic strip. But that technology will be unnecessary soon, as stores are all upgrading their credit-card readers these days… And it only works on a couple Samsung phones. So you can see, Samsung Pay will never be dominant.

“Square” is cool, too – you may have visited a small retailer who has a Square reader sticking out of his iPhone. This little square device allows him to swipe a card and have his phone act like a traditional credit-card reader. It’s great for little businesses. But Square likely won’t take over the world.

But while I expect most people will gravitate to Apple Pay or Android Pay, Apple and Alphabet (owner of Google and Android) won’t get rich off of them… and we as investors won’t see big returns in those stocks because of mobile pay.

Instead, the big winners – ultimately – should be the big credit-card companies like Visa and MasterCard.

The big credit-card companies will still end up processing the majority of mobile payments – it’s as simple as that. Take a look…

There’s not much money in it for Apple and Google at this point (if ever). The only upside they have is a small cut, and the perk of keeping people in their ecosystems. But there is money to be made, and market share to be gained for Visa and MasterCard.

And then there’s the infrastructure… Which companies make the new products that make all this mobile-payments stuff work? We will certainly have some big winners there. But who will they be?

Instead of trying to predict the winners, the safest plan for us is to buy all the players in this trend…

The best way to do that is through the PureFunds ISE Mobile Payments Fund (NYSE: IPAY).

IPAY’s top holdings are exactly what they should be…

| Percent | Name |

| 5.8% | MasterCard |

| 5.8% | Visa |

| 5.5% | PayPal |

| 5.0% | Fiserv |

| 5.0% | American Express |

| 4.9% | FleetCor |

If I had seen that MasterCard and Visa were the top holdings of this fund before I did my research, I would have thought this fund was not really a true mobile-payments play… But now that I’ve done my homework, I realize these are the only guaranteed winners in mobile payments.

The fund breaks down like this:

- 34% Payment processors (including Square and Fiserv)

- 29% Infrastructure and software (including Verifone)

- 19% Card networks (including MasterCard)

- 18% Solutions (including FleetCor)

IPAY is the safe way for us to play this trend. We are not picking winners. We are investing in the whole sector.

Today in the U.S., it would be darn difficult to exist without a wallet, cash, and credit cards. But in China, nobody wants to go back. And it only took about three years.

If my thinking is right, then mobile pay will explode in the U.S… Cash and traditional credit cards are basically done for, in the long run.

I urge you to get out in front of this trend in two ways…

First, I urge you to start using mobile payments – wherever you can – starting right now. Stop using your credit cards. They are not nearly as safe as mobile payments. It’s incredibly easy to do, too.

To get started, you need to go to Apple Wallet on your iPhone, or get Android Pay from the Google Play Store on your Android phone. Follow the instructions to link your credit card to your phone. Then you’re ready to pay with your phone.

The second thing I urge you to do is to invest in learning about this trend ahead of the crowd.

November 3, 2015

Sovereign Valley Farm, ChileIt was back in May 2010 that the very first real world Bitcoin transaction was conducted: 10,000 bitcoins traded for two Papa John’s pizzas.

Today that transaction would be worth nearly $4 million, probably making those the most expensive pizzas in the history of the world.

But back then it was considered revolutionary to trade a digital currency, something that few people really understood at the time, for a real product.

People are still skeptical of digital currency. But the concept itself is not so esoteric.

As Jim Rickards reminded me some time ago, MOST currencies are digital, even the US dollar.

The Federal Reserve’s estimate of US dollar money supply is $12.1 trillion; yet only about 10% of that is physical cash in circulation.

The rest梞ore than $10 trillion is simply a series of entries in banks’ core system databases.

In other words, the money in your savings account isn’t piled up inside your bank’s vault. Far from it.

Your savings doesn’t really exist. It’s all just digits in an electronic account ledger.

And yet we transact with these digital currency units all the time.

Whenever you use a credit card or send a bank transfer, you’re using the digital form of your currency.

This concept actually dates back to the Middle Ages when Italian bankers realized that they could conduct their transactions without physical money.

Rather than risk transporting gold coins across the countryside, medieval bankers merely annotated their ledgers with debit and credit entries.

They didn’t have the computers, but it was the same concept– they kept track of transactions and balances on account ledgers, instead of with physical money.

In the late 1960’s, the IMF took this idea to the next level when they created their own digital currency for the exclusive use of governments and central banks.

They’re called Special Drawing Rights (SDR, or XDR).

And even though the IMF’s balance sheet totals nearly 300 billion SDR (around $211 billion USD), not a single SDR exists in physical form.

100% of the SDR money supply is digital. Just like Bitcoin, One Coin, ect. it exists in computer databases, making it the digital equivalent of a 500-year old accounting system.

There is one key difference, though.

No one controls Bitcoin, One Coin or other Cyber Currencies. But dollars, euros, SDR, etc., are controlled by central banks.

Federal Reserve, Banque du Canada, Bank of Japan, etc. all decide how much of their currencies to create.

The SDR in particular is a total scam; the entire reason it was created was because the system didn’t have enough real savings.

So they solved the problem by creating a new digital currency that allowed them to easily conjure more money out of thin air.

But the even bigger risk is the commercial banks, which control your account balances. They keep all the records and ledgers, they hold all the keys.

This means that the money in your savings account isn’t really yours. You don’t actually have any savings.

What you really have is a claim on your bank’s savings. Your account is just an entry in the liability column of their digital ledger.

When you make a deposit, you’re trading your money for a banker’s promise to repay you.

And there are countless regulations giving them the authority to break that promise.

(If you want to test this premise, try withdrawing $25,000 just to see how your bank reacts.)

That’s the system that controls your wealth today. It’s almost entirely digital. And it’s run by unelected bureaucrats whose interests are not aligned with your own.

This is not a free system. And any rational person should consider parking at least a rainy day fund outside of this system.

Bitcoin, One Coin, and other cyber currencies are certainly one option.

No one controls it, which is a novel concept in an era when governments and central banks control everything from the value of your savings to what you can/cannot put in your own body.

But if Bitcoin isn’t your flavor just yet, consider other options such as One Coin to protect value without inflation or confiscation.

Gold and silver still have incredible merit since they cannot be conjured out of thin air by central banks.

And even holding physical cash is a much better alternative than keeping everything inside a highly centralized banking system.

Until tomorrow,

Simon Black

Founder, SovereignMan.com

Tom 1 Coin 7th Disruption

A Complete Beginner’s Guide To Blockchain

You may have heard the term ‘blockchain’ and dismissed it as a fad, a buzzword, or even technical jargon. But I believe blockchain is a technological advance that will have wide-reaching implications that will not just transform the financial services but many other businesses and industries.

A blockchain is a distributed database, meaning that the storage devices for the database are not all connected to a common processor. It maintains a growing list of ordered records, called blocks. Each block has a timestamp and a link to a previous block.

Cryptography ensures that users can only edit the parts of the blockchain that they “own” by possessing the private keys necessary to write to the file. It also ensures that everyone’s copy of the distributed blockchain is kept in synch.

Imagine a digital medical record: each entry is a block. It has a timestamp, the date and time when the record was created. And by design, that entry cannot be changed retroactively, because we want the record of diagnosis, treatment, etc. to be clear and unmodified. Only the doctor, who has one private key, and the patient, who has the other, can access the information, and then information is only shared when one of those users shares his or her private key with a third party — say, a hospital or specialist. This describes a blockchain for that medical database.

Blockchains are secure databases by design. The concept was introduced in 2008 by Satoshi Nakamoto, and then implemented for the first time in 2009 as part of the digital bitcoin currency; the blockchain serves as the public ledger for all bitcoin transactions. By using a blockchain system, bitcoin was the first digital currency to solve the double spending problem (unlike physical coins or tokens, electronic files can be duplicated and spent twice) without the use of an authoritative body or central server.

The security is built into a blockchain system through the distributed timestamping server and peer-to-peer network, and the result is a database that is managed autonomously in a decentralized way. This makes blockchains excellent for recording events — like medical records — transactions, identity management, and proving provenance. It is, essentially, offering the potential of mass disintermediation of trade and transaction processing.

How does blockchain really work?

Some people have called blockchain the “internet of value” which I think is a good metaphor.

On the internet, anyone can publish information and then others can access it anywhere in the world. A blockchain allows anyone to send value anywhere in the world where the blockchain file can be accessed. But you must have a private, cryptographically created key to access only the blocks you “own.”

By giving a private key which you own to someone else, you effectively transfer the value of whatever is stored in that section of the blockchain.

So, to use the bitcoin example, keys are used to access addresses, which contain units of currency that have financial value. This fills the role of recording the transfer, which is traditionally carried out by banks.

It also fills a second role, establishing trust and identity, because no one can edit a blockchain without having the corresponding keys. Edits not verified by those keys are rejected. Of course, the keys — like a physical currency — could theoretically be stolen, but a few lines of computer code can generally be kept secure at very little expense. (Unlike, say, the expense of storing a cache of gold in a proverbial Fort Knox.)

This means that the major functions carried out by banks — verifying identities to prevent fraud and then recording legitimate transactions — can be carried out by a blockchain more quickly and accurately.

Why is blockchain important?

We are all now used to sharing information through a decentralized online platform: the internet. But when it comes to transferring value – money – we are usually forced to fall back on old fashioned, centralized financial establishments like banks. Even online payment methods which have sprung into existence since the birth of the internet – PayPal being the most obvious example – generally require integration with a bank account or credit card to be useful.

Blockchain technology offers the intriguing possibility of eliminating this “middle man”. It does this by filling three important roles – recording transactions, establishing identity and establishing contracts – traditionally carried out by the financial services sector.

This has huge implications because, worldwide, the financial services market is the largest sector of industry by market capitalization. Replacing even a fraction of this with a blockchain system would result in a huge disruption of the financial services industry, but also a massive increase in efficiencies.

But it is the third role, establishing contracts, that extends its usefulness outside the financial services sector. Apart from a unit of value (like a bitcoin), blockchain can be used to store any kind of digital information, including computer code.

That snippet of code could be programmed to execute whenever certain parties enter their keys, thereby agreeing to a contract. The same code could read from external data feeds — stock prices, weather reports, news headlines, or anything that can be parsed by a computer, really — to create contracts that are automatically filed when certain conditions are met.

These are known as “smart contracts,” and the possibilities for their use are practically endless.

For example, your smart thermostat might communicate energy usage to a smart grid; when a certain number of wattage hours has been reached, another blockchain automatically transfers value from your account to the electric company, effectively automating the meter reader and the billing process.

Or, let’s return to our medical records example; if a doctor or patient issues a private key to a medical device, say a blood glucose monitor, the device could automatically and securely record a patient’s blood glucose levels, and then, potentially, communicate with an insulin delivery device to maintain blood glucose at a healthy level.

Or, it might be put to use in the regulation of intellectual property, controlling how many times a user can access, share, or copy something. It could be used to create fraud-proof voting systems, censorship-resistant information distribution, and much more.

The point is that the potential uses for this technology are vast, and I predict that more and more industries will find ways to put it to good use in the very near future.

Bernard Marr is a best-selling author & keynote speaker on business, technology and big data. His new book is Data Strategy. To read his future posts simply join his network here.

There’s a lot of hype in the air about blockchain technology at the moment. A recent World Economic Forum report predicts that by 2025 10% of GDP will be stored on blockchains or blockchain related technology. This means it’s probably something which everyone involved in business should take notice of. However, there’s still a lack of understanding about what it is, and what it does.

This makes it difficult for the layman to assess whether it’s something worthy of their time and attention. And for a new technology to become mainstream, let alone change the world (as blockchain enthusiasts claim it will) it must find a fan base beyond the technically-minded.

One way people describe blockchain technology is the “internet of value”. I like this term but it deserves closer inspection.

We have become used to sharing information through a decentralized online platform (the internet). But when it comes to transferring value – for example money – we are usually forced to fall back on old fashioned, centralized financial establishments such as banks. Even online payment methods which have sprung into existence since the birth of the internet – Paypal being the most obvious example – generally require integration with a bank account or credit card to be useful.

Blockchain technology offers the intriguing possibility of eliminating this “middle man”. It does this by filling three important roles – recording transactions, establishing identity and establishing contracts – traditionally carried out by the financial services sector.

Worldwide, the financial services market is the largest sector of industry by market capitalization. If blockchain technology can replace just a fraction of that by enabling peer-to-peer transactions in other sectors then it clearly has the potential to create huge efficiencies.

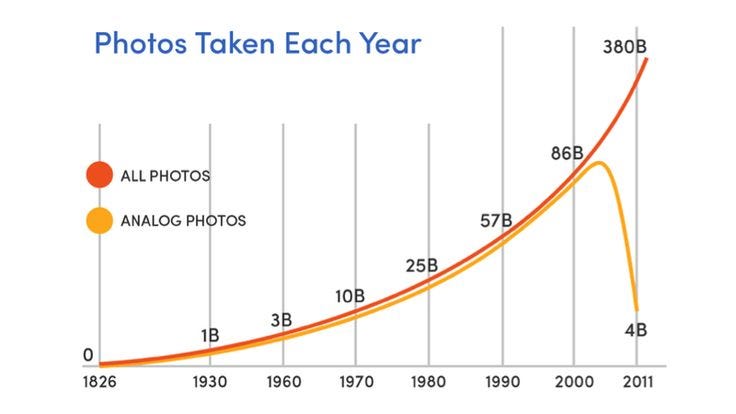

The technology was initially pushed into the headlines several years ago thanks to the virtual currency Bitcoin. The value of one unit of the currency (which is underpinned by blockchain technology) rose from pennies to over £$1,000 between 2011 and 2013, making a handful of early adopter enthusiasts very wealthy. Of course, this generated press interest. Since then, while Bitcoin’s value may have fallen and the currency established a more stable rate of growth, the buzz around the blockchain concept has intensified.

Recommended by Forbes

IBM, Microsoft and many others have announced services based on blockchain technology. Unsurprisingly, at the moment these are mainly aimed at financial services clients. It may represent the threat of extreme disruption to their industry – but of course they will still attempt to capitalize on it – that’s what they do, after all!

How Blockchain Technology Could Change The World

Bernard Marr , Contributor I write about big data, analytics and enterprise performance Opinions expressed by Forbes Contributors are their own.

There’s a lot of hype in the air about blockchain technology at the moment. A recent World Economic Forum reportpredicts that by 2025 10% of GDP will be stored on blockchains or blockchain related technology. This means it’s probably something which everyone involved in business should take notice of. However, there’s still a lack of understanding about what it is, and what it does.

This makes it difficult for the layman to assess whether it’s something worthy of their time and attention. And for a new technology to become mainstream, let alone change the world (as blockchain enthusiasts claim it will) it must find a fan base beyond the technically-minded.

One way people describe blockchain technology is the “internet of value”. I like this term but it deserves closer inspection.

We have become used to sharing information through a decentralized online platform (the internet). But when it comes to transferring value – for example money – we are usually forced to fall back on old fashioned, centralized financial establishments such as banks. Even online payment methods which have sprung into existence since the birth of the internet – Paypal being the most obvious example – generally require integration with a bank account or credit card to be useful.

Blockchain technology offers the intriguing possibility of eliminating this “middle man”. It does this by filling three important roles – recording transactions, establishing identity and establishing contracts – traditionally carried out by the financial services sector.

Worldwide, the financial services market is the largest sector of industry by market capitalization. If blockchain technology can replace just a fraction of that by enabling peer-to-peer transactions in other sectors then it clearly has the potential to create huge efficiencies.

The technology was initially pushed into the headlines several years ago thanks to the virtual currency Bitcoin. The value of one unit of the currency (which is underpinned by blockchain technology) rose from pennies to over £$1,000 between 2011 and 2013, making a handful of early adopter enthusiasts very wealthy. Of course, this generated press interest. Since then, while Bitcoin’s value may have fallen and the currency established a more stable rate of growth, the buzz around the blockchain concept has intensified.

Recommended by Forbes

Research Shows Mobile Banking Lifting Hundreds of Thousands from Poverty

found at: http://fortune.com/2016/12/10/mobile-banking-poverty-research/

by David Z. Morriss

10th December 2016

Latema Street near River Road in Nairobi, Kenya. Photograph by Getty Images/Lonely Planet Image

Kenya’s M-Pesa has helped the poor, and the country’s entire economy, while turning a profit.

In a study published Friday in the journal Science, economists at MIT and Georgetown have found that a service allowing users to send and receive money on their mobile phones has significantly reduced poverty in Kenya.

According to long-term surveys, M-Pesa (short for “mobile money” in Swahili) helped 194,000 families, or 2% of Kenyan households, out of poverty between 2008 and 2014. Among other factors, the authors found that M-Pesa makes it easier to weather financial or health crises, both by increasing savings rates and allowing users to tap wider support networks. The effect was particularly pronounced for women and female-led households, which previous analysis has attributed to mobile banking’s tendency to give women more power in typically patriarchal societies.

Get Data Sheet, Fortune’s technology newsletter.

At the highest level, the study credits mobile banking with increasing the efficiency of the entire Kenyan economy, by helping users make more productive choices both on spending and employment. Kenya’s economic growth has been remarkable in recent years, with an expansion of of 5.3% in 2014, and projections putting 2016 growth at 6.0%—within striking distance of China’s recent growth of 6.7%.

In addition to its broader economic benefits, M-Pesa has been a business triumph. In November, M-Pesa operator Safaricom reported half-year profits of 23.9 billion Kenyan shillings, or about $234 million U.S. dollars. M-Pesa, which charges users small fees, generated about 1/4th of total revenue. M-Pesa now has 17.6 million active users in Kenya, with, according to the new study, at least one user in 96% of Kenyan households.

The new research seems to bear out predictions made by figures including Bill Gates, whose foundation has made investments in mobile banking tech in Bangladesh as part of its campaign against global poverty.

M-Pesa users can make deposits and withdrawals from their mobile accounts with 110,000 agents, in addition to sending and receiving money over the digital network. Other services, including mobile-only credit lines and retail payment systems, have been added recently.

While this study focused on Kenya, similar mobile banking services are now available in 93 countries, with a total of 134 million active accounts. In nearly half of these markets, mobile services are vastly more accessible than traditional banking. It seems safe to assume, then, that the services are having similar effects in poverty reduction and economic development around the world.

Richard Branson: Blockchain could create ‘economic revolution’ in emerging markets

Monday, 3 Oct 2016 | 8:59 AM ETCNBC.com

Blockchain technology could bring an “economic revolution” in many developing countries where proving ownership of assets or getting access to capital is difficult, Virgin Group founder and billionaire entrepreneur Richard Branson said on Monday.

Branson referenced the work of well-known economist Hernando de Soto, who recently announced a partnership wtih bitcoin and blockchain company BitFury and the Republic of Georgia’s National Agency of Public Registry, to trial a land titling program.

Blockchain works like a huge, decentralized ledger for the digital currency bitcoin which records every transaction and stores this information on a global network so it cannot be tampered with. It’s this technology that banks feel can be utilized in areas from remittances to securities exchanges.

The technology can be used to keep an immutable record of ownership and has been trialed for banks to carry out the trading of assets.

In developed markets, proving ownership of land is easy. But in many developing markets, this can be difficult.

“If you take somewhere like Egypt, 90 percent of people have got houses, they’ve got a garden, but they’ve got no piece of paper to show ownership of that … And without ownership of your property, it’s almost impossible to start a business or get a bank loan or anything,” Branson told an audience at the “Virgin Disruptors” event in London.

Branson added that the use of blockchain technology could create a “real .. .economic revolution in these countries that would be stagnating.”

It’s not the first time Branson has spoken about blockchain technology. The entrepreneur has hosted the “Blockchain Summit” on his private Necker Island for the last two years.

Arjun KharpalTechnology Correspondent

How Digital Currency Will Change The World

Digital currency may be the most effective way the world has ever seen to increase economic freedom. If this happens, the implications are profound. It could lift many countries out of poverty, improve the lives of billions of people, and accelerate the pace of innovation in the world.

This is why I co-founded a digital currency company. I believe it is the highest leverage activity I can be doing right now to improve the world.

In this post, I’ll attempt to explain what economic freedom is, why it is important, and how digital currency can change it.

What is economic freedom?

Economic freedom is a measure of how easy it is for members of a society to participate in the economy. It has a number of factors, such as:

- How easy it is to start a business

- Whether property rights are enforced (can you keep what belongs to you)

- Free trade with other nations

- Regulation of labor and business

- Stability of the currency

- etc

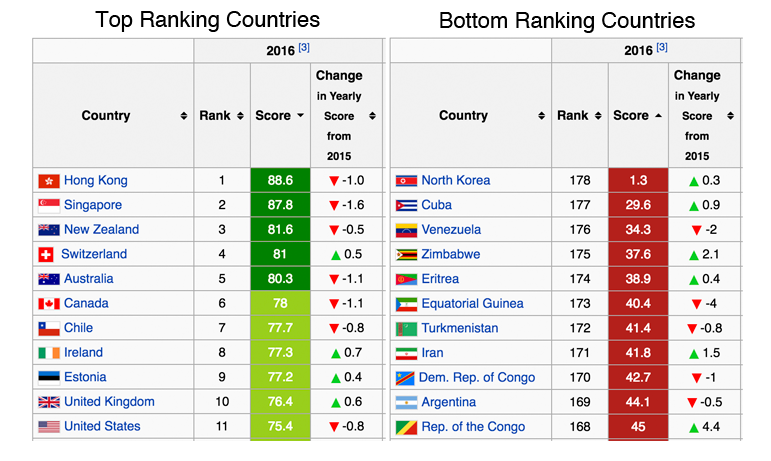

Several organizations exist that score and rank the countries of the world by how economically free they are. The data shown below is published by the Heritage Foundation and Wall Street Journal. Here are the top and bottom ranking countries from their 2016 list.

By looking at the names on the two lists you can start to get a sense of why economic freedom may be important, but here is another way to look at it.

Why is economic freedom important?

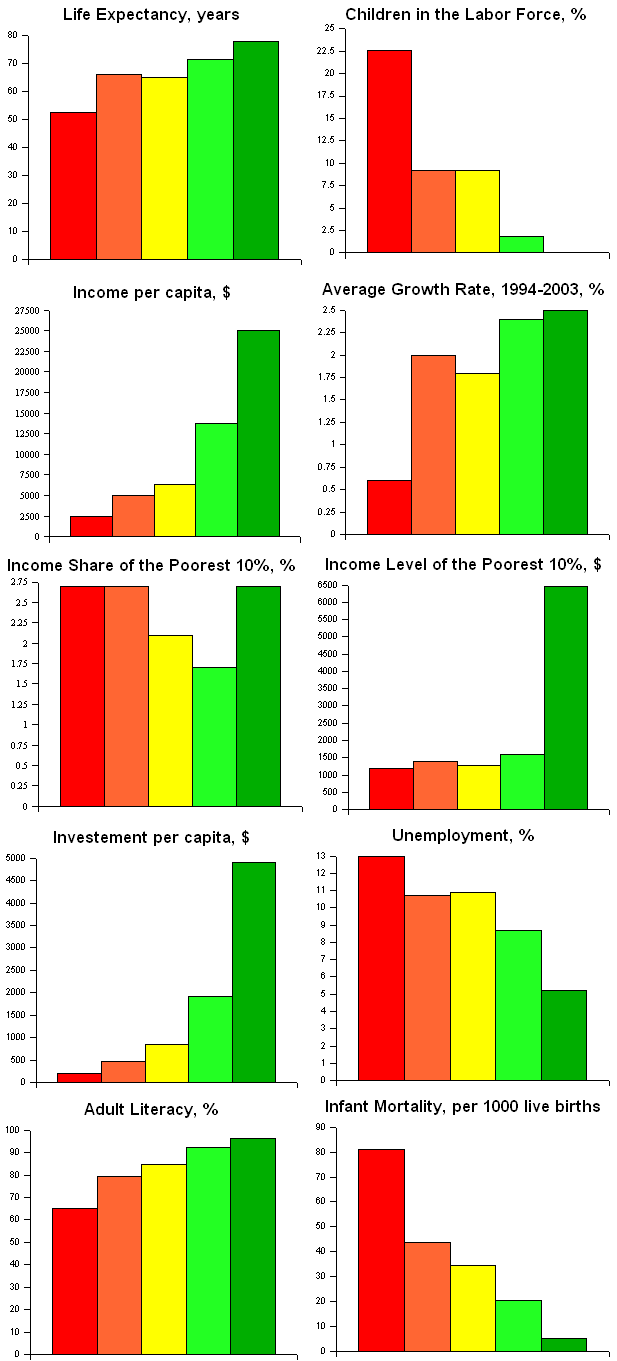

Economic freedom correlates with a number of positive outcomes in society.

Some you might expect, like higher per-capita income, life expectancy, and literacy. But economic freedom also correlates with some things you may not expect, like:

- Better income for the poorest 10%

- Improved environmental protection

- Fewer wars and violent conflicts

- Higher self-reported happiness of citizens

- Less corruption and bribery

The red bars show nations with less economic freedom, the green bars those with more.

When I first read this I was surprised more people didn’t know about it.

Correlation, of course, does not prove causation, so we must be careful not to jump to too many conclusions. Societies are very complex, and what works in one place may not necessarily work in another. Still, it raises an important question: if the world had more economic freedom would we all be better off?

Digital currency’s impact on economic freedom

In the past, if you wanted to change economic freedom you had to run for office or lobby the government. If you spent one year in every country of the world working toward this, it would take you 196 years (and you probably wouldn’t move the needle much spending one year per country).

But with the proliferation of smartphones, there is now a way to rapidly bring digital currency into almost every country in the world.

This is how digital currency enables economic freedom:

- It makes it easier to start a business

Anyone with an idea can have customers around the world in just a few hours. It reduces the friction of accepting payments, and helps companies expand globally. - It enforces property rights

Many people today are unable to safely store wealth without it being stolen or confiscated. Digital currency will allow anyone to be in control of their own money (see brain wallets). In this sense, digital currency will “bank” the unbanked of the world. - It promotes free trade and globalization

Digital currency excels at cross border transfers. It breaks down barriers for people in different countries to trade with each other (for example to get a loan, or hire someone to complete a job). - It enables freedom of contract

With Ethereum smart contracts, the hurdle has been lowered for people to enter agreements, regardless of where they live or whether they can afford a lawyer. - It encourages people to leave low scoring countries

People will find it easier to emigrate if they can take their wealth with them and use it in a neighboring country. Digital currency makes every country’s economy interoperable. With lower switching costs, countries will improve. - It reduces corruption and bribery

With fewer gatekeepers and intermediaries to start a business, there won’t be as many places to apply pressure or curry favor. - It provides access to stable currency

Digital currencies are more volatile than the dollar or euro today, but their volatility has decreased every year (and are now approaching the levels of some fiat currencies). In the coming years, digital currency will be more stable than many of the 180+ fiat currencies in the world.

Today, digital currency is still in early stages. But as with many technologies, when it tips the result can be dramatic.

Digital currency has a number of applications emerging today (prediction markets, micro-payments, smart contracts, remittance, games, etc). But I think digital currency could “tip” in at least one developing country by 2020, where it accounts for the majority of transactions in that economy. From there it could spread rapidly.

Conclusion

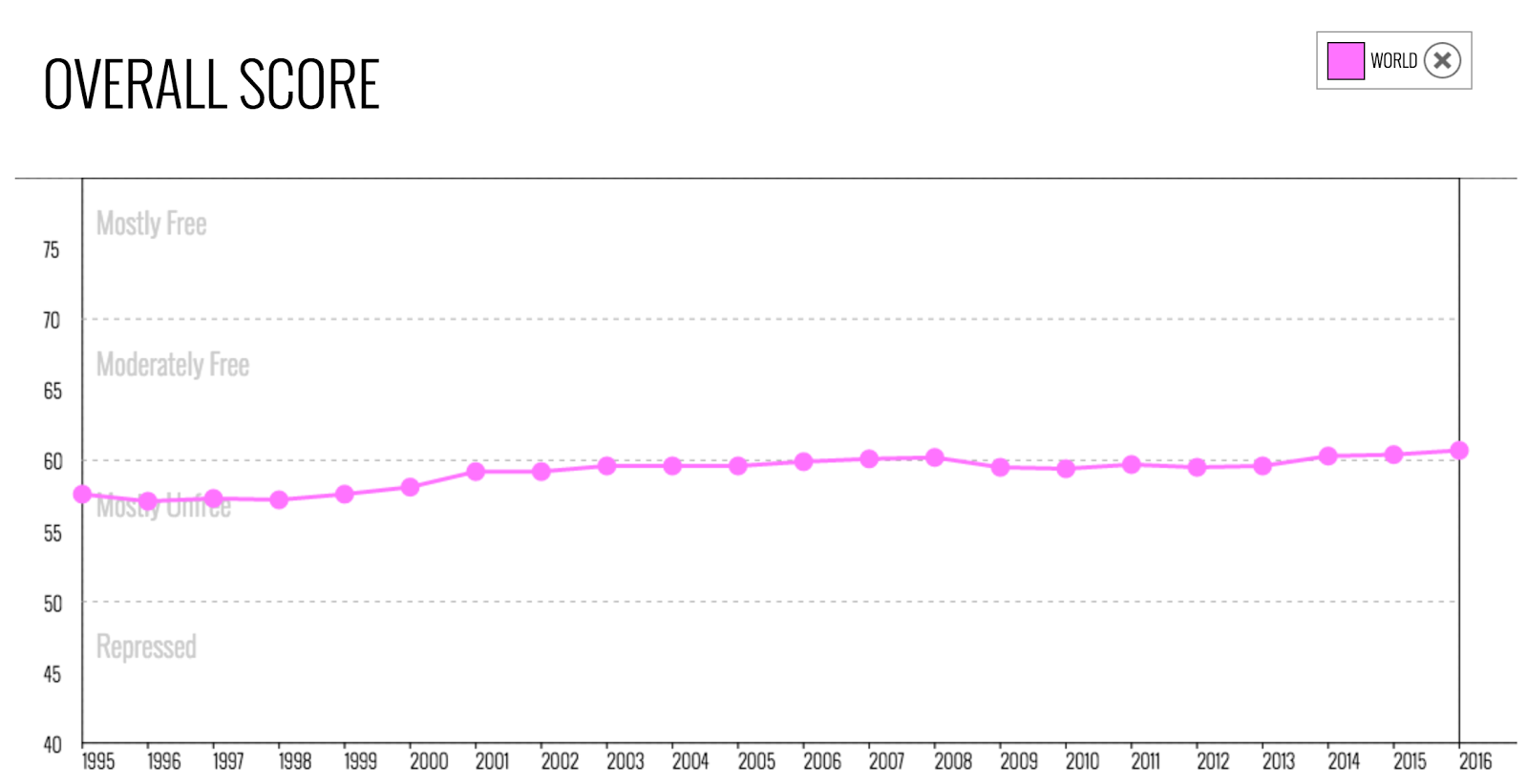

Over the past 20 years, the global average economic freedom has gone up by only 3 points (from 57% to about 60%). Things are moving in the right direction, but far too slowly.

With the invention of digital currency, I believe we can dramatically increase the economic freedom of the world, perhaps raising it as high as 75% in the next 10 years.

Economic freedom is one of the great meta-problems of our time (right up there with A.I., quantum computing, and cheap renewable energy). If we can create more economic freedom in the world, it will serve as a giant economic stimulus package for the world, accelerate innovation, reduce wars, make the poorest 10% better off, overthrow corrupt governments, and raise happiness.

For the first time in history, just a couple hundred people can have a material impact on the economic freedom of the world by making a new technology accessible to the masses. If this mission is of interest to you, please get in touch with us.

Thank you to Rose Broome, D. Scott Phoenix, John Yi, Erin Coppin, Adam White, Dave Farmer, Dan Romero, Fred Ehrsam, and Nathalie McGrath for reviewing drafts of this post.

Footnotes

- A meta-problem is a problem where if you solve it, you automatically solve an entire class of problems.

- The U.S. has fallen from 7th place in 2008 to 11th place in 2016, primarily due to increased government spending after the 2008 financial crisis.

- For more on this topic, see our mission and vision.

- A better measure of global economic freedom might be the score of each country multiplied by the size of its population. With this measure, it would be possible to raise global economic freedom when people emigrate to higher scoring countries, even if their home country does not improve.

A Radical Shift in the Way We Do Business Is Coming…

Editor’s Note: Today’s issue is a little different from usual…

In place of our regular daily market commentary, we’re going to tell you about a key development in the markets.

Although this trend is extremely important, most Americans don’t know about it yet. But soon, it will be on the front page of major papers like The Wall Street Journal and The New York Times.

E.B. Tucker, editor of The Casey Report, has been studying this trend for months. Below, you’ll read why it’s so important…and what it means for your stock market investments.

Casey Daily Dispatch will return to its regular format on Monday.

Regards,

Justin Spittler

Delray Beach, Florida

January 29, 2016

As you read this, Wall Street CEOs are panicking.

They’re holding secret meetings about a new technology that’s going to change the financial world…and potentially make them obsolete.

Soon, you’ll be reading about this technology on the front page of The Wall Street Journal and The New York Times.

It’s going to radically change how people do business…just like the Internet changed how people share information.

I know these are big claims. Let me explain…

The new technology is called “blockchain.” You may know it as the engine behind bitcoin, the digital currency created in 2008.

You can think of blockchain as the plumbing that makes bitcoin work. But blockchain is not bitcoin.

Unlike bitcoin, blockchain is not a currency, and it’s not money. It’s a technology that’s going to change the way people buy and sell things.

It’s more secure, cheaper, and far more reliable than any system of payment that exists today – including cash, checks, and credit cards.

Soon, you’ll use blockchain to buy a TV, a car, or a stereo. You’ll also use it to buy things like stocks, bonds, and real estate.

Blockchain 101

Blockchain is an “open ledger.” It keeps track of transactions, just like an old-fashioned ledger on a store clerk’s counter.

But the store clerk’s ledger is only for him to see. You’ll need a warrant to see it even if you’re a paying customer. If you do get a warrant, he might change it before you see it.

An open ledger is different. It’s visible to everyone involved in a transaction. Buyers, sellers, regulators, and anyone granted access can see the ledger. Plus, everyone involved in the transaction has their own copy of the ledger on their computer, and all copies must agree. This prevents stealing or fraud.

Here’s an example. When you buy a pair of shoes using blockchain, both you and the seller “broadcast” the transaction over the Internet. Everyone updates their copy of the ledger for your transaction. Then everyone compares ledgers. When there’s disagreement about the content, the most common ledger is accepted as the “truth.”

Then the transaction becomes permanent. The record in the ledger can’t be changed unless all people in the transaction agree to it.

We call this “decentralization”…because it takes the power out of the hands of a single institution like a bank. And it puts the power in the hands of the people doing the transaction.

With blockchain, no central authority or group can manage or manipulate a transaction. And no one can steal things that are secured by blockchain. Not thieves, hackers, or even the U.S. government.

This incredible security is what makes blockchain so amazing.

In 2013, the U.S. government tried to seize over 600,000 bitcoins worth over $100 million. The Department of Justice claimed the owner of these bitcoins was breaking the law.

However, because bitcoins are built on blockchain technology, the bitcoins were worthless to the U.S. government. Only the owner could sell or spend them. If he didn’t agree to the transaction, they could not be sold or spent. Period.

| Recommended Links | ||||||

|

||||||

| — | ||||||

Changing the Way We Buy and Sell

A long time ago, people bought and sold things face-to-face. If you wanted a pair of shoes, you bought them from the town shoemaker.

This changed as technology advanced. Today, you can buy something from China without ever knowing the seller.

Companies like Amazon, the gigantic online retailer, make this possible. In exchange for connecting buyers and sellers and making sure the transactions run smoothly, Amazon generates tens of billions of dollars in sales per year. Amazon is the sixth-largest publicly traded company in the U.S., worth $317 billion.

Or think of it this way. You’re reading a financial newsletter, so you likely buy and sell stocks. When you buy a stock, how do you know the seller actually owns the stock? How do you know he won’t take your money and run? And how does he know you’ll actually pay for the stock?

You may never think about these things. But making sure stock transactions run smoothly is big business for Wall Street. It’s a full-time job for tens of thousands of highly paid lawyers, accountants, bankers, brokers, and custodians. In exchange, we pay them hundreds of billions of dollars in fees and commissions.

In 2008, we saw these “middlemen” collapse. Markets froze up. These pillars of our financial system are not as strong as we thought they were.

Blockchain can replace these middlemen. It’s faster, cheaper, and more secure than the middlemen.

For example, when you place an order with your broker to buy a share of stock, it takes three full business days to “settle” (for you to actually own the share of stock). This means it takes 72 hours to buy, pay for, and officially own a share of stock.

This same process would take less than a minute on a blockchain. It’s like the difference between mailing a letter and sending an email.

And stock ownership recorded on a blockchain isn’t some far-off dream. It’s about to happen right now. Online discount retailer Overstock.com (OSTK) just got clearance from the U.S. Securities and Exchange Commission (SEC) to issue up to $500 million worth of stock on a blockchain. Other companies will follow suit.

NASDAQ announced a blockchain-based stock-trading platform called Linq last year. Other exchanges will follow.

Credit card companies like American Express, Visa, and MasterCard have also invested millions in blockchain. They know the way we buy and sell things is about to radically change. And they don’t want to be left behind.

Editor’s Note: For months, E.B. Tucker has been studying how technologies like blockchain will change how we pay for things. Through his research, he learned that physical credit cards are becoming obsolete. So he told Casey Report readers to short (bet against) VeriFone (PAY), the company that makes the credit card terminals you see at most cash registers. Readers have already made 25% in 4 months.

In the latest Casey Report, E.B. recommends owning three key companies that “feed the masses” in America. You can get in on these picks by taking The Casey Report for a 100% risk-free trial. Click here to get started.

I am involved in One Coin and recommend that you go with iPro as I have done..

A far more evolved program for introducing Digital Currency to the masses

DIGITAL CURRENCY ADOPTION BY GOVERNMENTS

found at: http://africointutorials.com/governments

As of 2016, over 24 countries are investing in distributed ledger technologies (DLT) with $1.4bn in investments. In addition, over 90 central banks are engaged in DLT discussions, including implications of a central bank issued digital currency.

Canada

The Bank of Canada have explored the possibility of creating a version of its currency on the blockchain.

The Bank of Canada teamed up with the nation’s five largest banks — and the blockchain consulting firm R3 — for what was known as Project Jasper. In a simulation run in 2016, the central bank issued CAD-Coins onto a blockchain similar Ethereum. The banks used the CAD-Coins to exchange money the way they do at the end of each day to settle their master accounts.

China

A deputy governor at the central bank of China, Fan Yifei, wrote that “the conditions are ripe for digital currencies, which can reduce operating costs, increase efficiency and enable a wide range of new applications.”. According to Fan Yifei, the best way to take advantage of the situation is for central banks to take the lead, both in supervising private digital currencies and in developing digital legal tender of their own.

Denmark

The Danish government proposed getting rid of the obligation for selected retailers to accept payment in cash, moving the country closer to a “cashless” economy. The Danish Chamber of Commerce is backing the move. Nearly a third of the Danish population uses MobilePay, a smartphone application for transferring money.

Netherlands

The Dutch central bank is experimenting with a bitcoin-based virtual currency called “DNBCoin”.

Russia

Government-controlled Sberbank of Russia owns Yandex.Money – electronic payment service and digital currency of the same name.

South Korea

South Korea plans national digital currency using a Blockchain. The chairman of South Korea’s Financial Services Commission (FSC), Yim Jong-yong, announced that his department will “Lay the systemic groundwork for the spread of digital currency.”

Switzerland

In 2016, a city government first accepted digital currency in payment of city fees. Zug, Switzerland added bitcoin as a means of paying small amounts, up to SFr 200, in a test and an attempt to advance Zug as a region that is advancing future technologies. In order to reduce risk, Zug immediately converts any bitcoin received into the Swiss currency.

Swiss Federal Railways, government-owned railway company of Switzerland, sells bitcoins at its ticket machines.

United Kingdom

The Chief Scientific Adviser to the UK government advised his Prime Minister and Parliament to consider using a blockchain-based digital currency.

The chief economist of Bank of England, the central bank of the United Kingdom, proposed abolition of paper currency. The Bank has also taken an interest in bitcoin. In 2016 it has embarked on a multi-year research programme to explore the implications of a central bank issued digital currency. The Bank of England has produced several research papers on the topic. One suggests that the economic benefits of issuing a digital currency on a distributed ledger could add as much as 3 percent to a country’s economic output. The Bank said that it wanted the next version of the bank’s basic software infrastructure to be compatible with distributed ledgers.

Ukraine

The National Bank of Ukraine is considering a creation of its own issuance/turnover/servicing system for a blockchain-based national cryptocurrency. The regulator also announced that blockchain could be a part of a the national project called “Cashless Economy”.

Nigeria

A former Deputy Director of the CBN and senior lecturer with the Department of Economics, University of Lagos, Dr Emmanuel Balogun explained that e-payments have come to replace the traditional fiat money.

“In a country like ours which is fully reliant on hard currencies, the e-payment money would be of a significant advantage to the CBN. It is not that CBN is just going into it, it is already a policy. The technology is based on what we call Real Time Gross Settlement (RTGS). This time around, you have direct access to your account irrespective of your bank and where it is located and that is why you can draw from your ATM card anytime and anywhere in the world. That’s what we are talking about” Balogun said.

contact me for additional information

Jim Hamilton

310 878-2260 pst

jhamilton [at] visionarieslab [dot] com

or go to:

http://COREres.ipronetwork.com

http://COREres.ipronetwork.com/webinar-replay

http://COREres.ipronetwork.com/join